Budget Office

Welcome to the Georgia Highlands College Budget Office

Our Mission

As part of the Office of Vice President, it is the mission of the Georgia Highlands College Budget Office to deliver the highest quality budget management and information services to the College community and external constituents using the most appropriate and progressive technology.

Our Functions

The primary functions of the College Budget Office are:

- To assist the Institution in developing, implementing, and monitoring the College’s annual operating budget. The office serves as principal staff for all budgetary purposes, preparing all agenda materials and implementing budgetary decisions.

- To support the College strategic planning and budget process through participation in deliberations of committees and hearing panels, presentation of essential institutional data and preparation of various analyses and reports.

- To serve as the primary office for complying with the College’s central external reporting requirements. In most cases, the reports are prepared by the Office. In other cases, consistent, official data are provided to other offices for reporting purposes.

Our Services

Some of our services include:

- Budget Development, Implementation, & Monitoring

- Tuition Modeling

- Common Data Set

- Appropriation Process

- Institutional Reporting

- Analytical Studies

- IPEDS

- State Reporting

Important Links

Common Budget Terminology

Budget – Financial plan containing estimates of revenues and expenditures for one fiscal year that integrates competing demands while working towards the college’s mission.

Budget Amendment – When funds must be transferred from one budget to another, a budget amendment form must be completed, signed by the budget unit director, and forwarded to the Budget Office for processing. This form must also be completed when moving funds from different account categories.

Encumbrance – When a purchase order is issued, the funds for the purchase must be reserved. The process of reserving the funds is referred to as encumbrance. Once funds are encumbered, they are removed from the balance available.

Expenditure – Refers to the actual funds expended.

Fiscal Year – The College’s fiscal year runs from July 1 through June 30.

Current Funds – Funds available to the college for use in achieving any of its authorized institutional purposes.

- Unrestricted – Funds which the college retains full control of their use

- Restricted – Funds which are externally restricted and may only be used in accordance with the established purpose

Educational and General Expenditures

Functional Expenditure Categories

Instruction – includes expenses for all activities that are part of an institution’s instruction program. Expenses for academic credit and noncredit courses.

Academic Support – includes expenses to provide support for the college’s primary mission of instruction, research, and public service; includes libraries, and academic administration.

Student Services – includes expenses incurred for offices of admissions and the registrar and activities with the primary purpose of contributing to students’ emotional and physical well-being and intellectual, cultural, and social development outside the context of the formal instruction program.

Institutional Support – includes expenses associated with executive management, fiscal operations, personnel services, administrative computing, and alumni and development.

Operation and Maintenance of Facilities – includes expenses associated with the operation and maintenance of buildings and grounds, utilities, custodial services, and campus security.

Scholarships and Fellowships – includes expenses for aid to students in the form of monetary grants resulting from selection by the institution or from an entitlement program.

Auxiliary Services – includes expenses associated with the operation of the card office, campus safety department, and athletics.

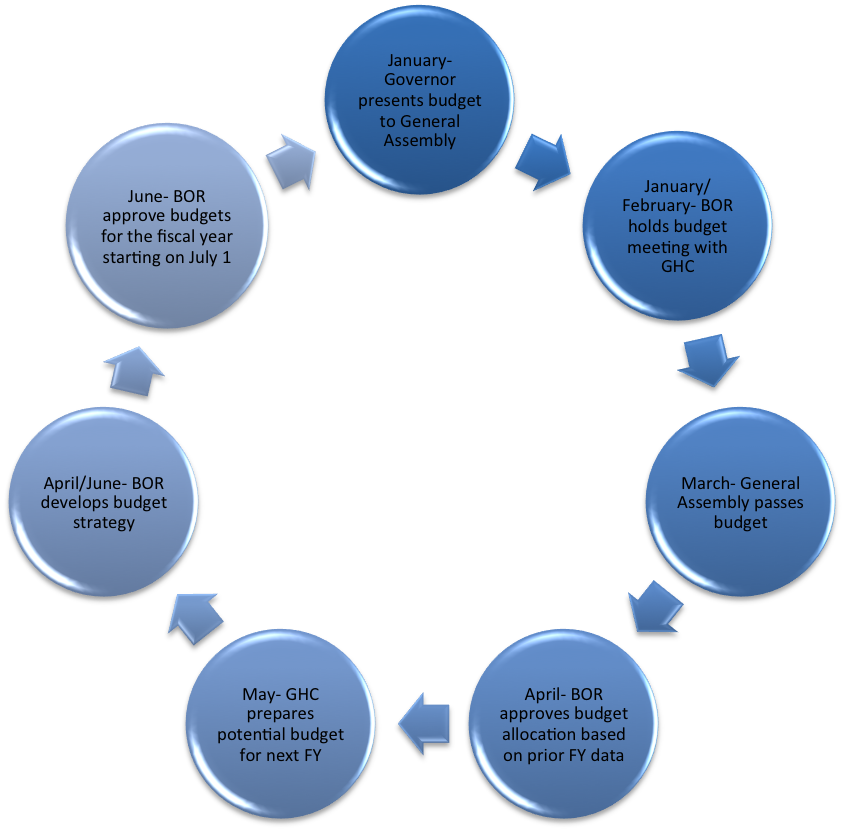

- January – Governor presents budget to General Assembly

- January / February – BOR holds budget meeting with GHC

- March – General Assembly passes budget

- April – BOR approves budget allocation based on prior FY data

- May – GHC prepares potential budget for next FY

- April / June – BOR develops budget strategy

- June – BOR approve budgets for the fiscal year starting on July 1

Definition of Funds

- Fund 10000 – State Appropriation

- Fund 10500 – Tuition

- Fund 10600 – Course Fees and Institutional Fee

- Fund 12xxx – Auxiliary

- Fund 13000 – Student Services & Student Engagement

- Fund 14000 – Sales and Services

- Fund 16000 – Technology Fee

How can each fund by USED?

Fund 10000 Salaries and OS&E (Lapse @ year end)

Fund 10500 Salaries and OS&E (Lapse @ year end)

Fund 10600 lab expenses, expenses related to course delivery. (Lapse@ year end)

Fund 12xxx Salaries, OS&E, and Expenditures related to Auxiliary Services (ie, Dining Services, Campus Safety, Card Services, and Athletics)

Fund 13000 Salaries, OS&E, and Expenditures related to Student Activities (ie, Food, Drinks, Six Mile Post, Orientations, Intramurals, Student Government Organizations, etc.

Fund 14000 Salaries, OS&E, and Expenditures related to workshops conducted by Continuing Education and the dental hygiene clinic.

Fund 15000 OS&E

Fund 16000 Computers and software (Student Related Only)

Fund 20000 All expenditures are according to each specific grant “contract”

Fund 50000 Capital expenditure items such as major repairs and renovations and purchase of capitalized equipment

Fund 60000 All expenditures are according to each specific agreement on file. Typical expenditures include but are not limited to supplies.

Where does GHC get our funding?

State Appropriations Fund 10000

Under constitutional authority, the BOR approves the annual budget request for the entire University System.

The USG allocates funds to each institution based on a formula of:

Enrollment

Facility Square Footage

New for FY15 Additional Funding for Student Completion

Tuition Fund 10500

In state and Out of state Tuition

Other Revenue Fund 10600

Course Fees, Lab Fees, Institutional Fee