Test Inspiration: As the April tax filing deadline in the US approached, March witnessed a significant uptick in phishing emails impersonating the IRS. This trend was not isolated to the US alone. The end of the global fiscal year saw similar impersonation attempts targeting HM Revenue and Customs in the UK, as well as other tax authorities worldwide. The primary motive behind these phishing emails was to exploit the fear of fines and penalties, compelling recipients to take hasty actions.

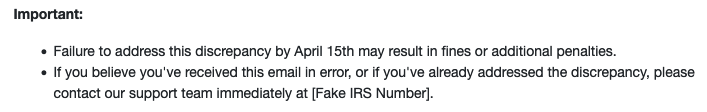

Phishing Email Context: The phishing email was crafted to appear as an official communication from the IRS. It highlighted a purported discrepancy in the recipient’s tax forms and emphasized the urgency to rectify this to avoid fines. The email provided a link to a so-called “secure portal” where recipients were asked to log in using sensitive personal information. The sense of urgency was further amplified by setting a specific deadline and mentioning potential penalties.

Bonus Tip: Please do not give out information for an email that has [Fake IRS Number] in the email.

Key Findings & Recommendations:

- Sender Verification: Always double-check the sender’s email address. Official communications from the IRS will typically come from a “.gov” domain.

- Avoid Sharing Sensitive Information: Legitimate entities like the IRS will never ask you to share sensitive information, such as your Social Security Number, via email.

- Verify Before Clicking: Always be skeptical of links in unsolicited emails. Hover over the link to see the actual URL and ensure it’s a legitimate site.

- Check for Personalization: Genuine IRS communications will often be more personalized and won’t use generic greetings like “Dear Citizen.”

- Contact Directly: If in doubt, contact the IRS or the respective tax authority directly using official contact details, not the ones provided in the suspicious email.

- Report Suspicious Emails: If you come across a potential phishing email, report it via the Phish Alert button.

Conclusion: Tax season is a prime time for cybercriminals to exploit individuals using the fear of penalties. Staying informed and vigilant is the best defense against such phishing attempts.